Learning complex financial concepts like derivative securities is challenging. Students can struggle with the technical terminology, the trading platforms, and find it difficult to connect the theory to real market conditions.

In Semester 1, 2025, the teaching team of FINC6010 Derivative Securities worked with the Business Co-Design team tackle these challenges head-on. They integrated AI chat agents to support students at key points of their learning. This initiative, led by educators Associate Professor Quan Gan, Dr. Daisy Liu, and Mr. Stephen Fan, aimed to engage students, help them to think more critically, and to apply their knowledge.

Targeting support when students need it most

The team focused on responsible use of AI for learning support before assessment, rather than as a tool for grading or evaluation. Using the Cogniti platform, they created four targeted agents to tackle the common challenges students face in FINC6010. Their approach was systematic: a step-by-step framework carefully designed to help students build foundational trading concepts and then apply them to practical trading strategies.

Agent 1: Establishing Foundational Knowledge

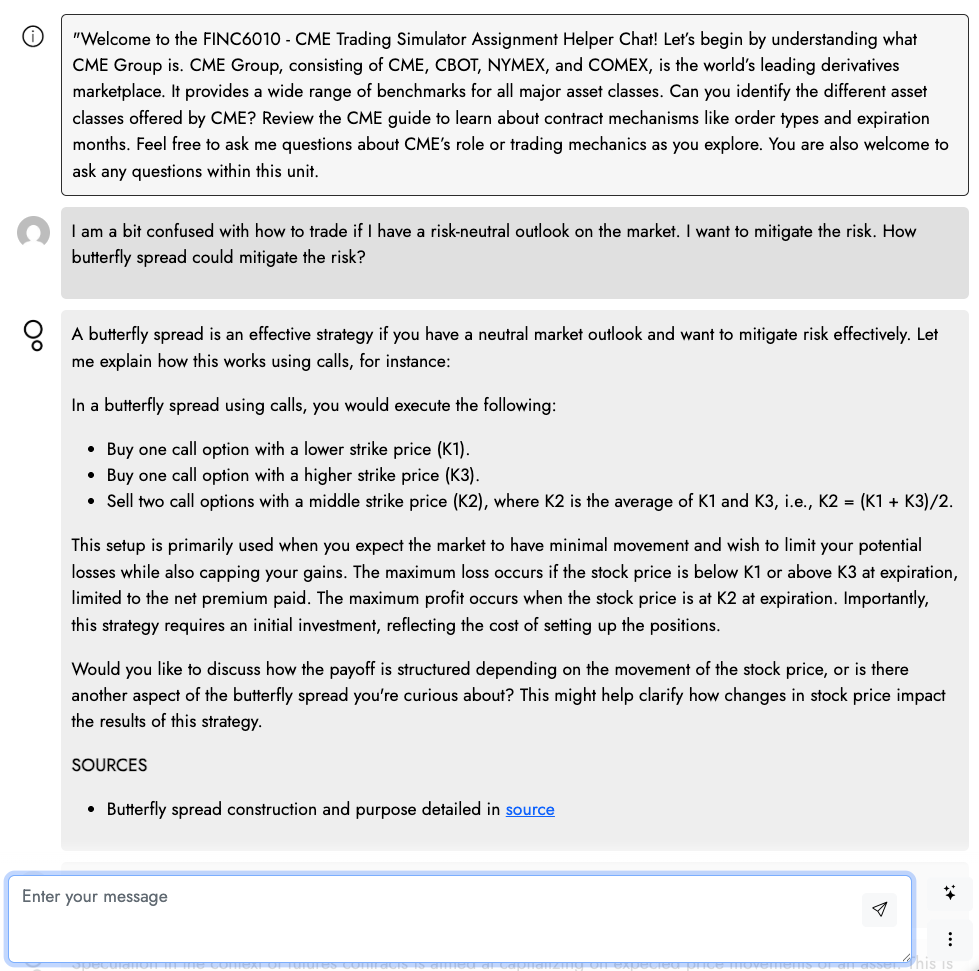

First, a chat agent for students was developed for students new to derivative securities so they could familiarise themselves with the CME trading platform. This Cogniti agent delivers easy-to-understand prompts and outputs to guide students through the platform, introducing essential trading terms and explaining CME’s role in global markets. By doing so, the agent builds student confidence in setting up trades effectively, ensuring they are well-prepared to engage with advanced concepts as the unit progresses.

Agent 2: Real-World Trading Applications

This AI agent plays a key role in bridging theoretical academic concepts and practical scenarios that students are likely to encounter in real-world trading. The agent challenges students to navigate and consider the nuances of market behaviour. It also guides them in identifying and analysing discrepancies between their textbook assumptions and actual market dynamics, for a deeper understanding of the impact of real-world variables on trading strategies. Students critically evaluate AI-generated strategies, compare outcomes across different scenarios, and reflect on the effectiveness of various approaches. This is important for informed, evidence-based decision-making in trading.

Agents 3 & 4: Q&A and Submission Support

The unit has over 1000 students enrolled each year, so an AI chat agent was created that incorporates a database of common queries from prior semesters. It also has detailed instructions on student submission standards to help resolve common concerns. This timely and accurate guidance encourages students to be active and independent in their learning. Students are directed to internal resources to seek clarification and explore alternative solutions.

The results so far?

Students found the experience to be insightful, engaging, and occasionally rigid! Many commented on how the AI chatbot clarified complex trading concepts, such as directional bias, hedge structuring, and option payoff design, and encouraged them to think more strategically about risk. The novelty of interacting with Cogniti.AI reshaped students’ perception of financial decision-making and introduced a fresh, dialogic mode of learning. This approach also helped them apply textbook knowledge to real-world trading scenarios.

One student remarked:

Cogniti gave me a strong mental model to start from. I didn’t follow it blindly, but it helped me think like a risk manager.

Another described how the agent’s suggestion to combine stop-limit and MIT orders inspired her to “think beyond textbook strategies and develop a hybrid approach tailored to crypto volatility.”

These early reactions suggest that the chatbot not only supported conceptual understanding but also challenged students to apply and even question AI-generated strategies, leading to deeper critical reflection. It suggests that AI in finance can help simplify complex concepts, sustain student interest, and create new ways to interact. Watch this space!

If you’re interested in creating your own Cogniti agent, the following pages will help you.

- Read more about Cogniti at https://cogniti.ai/docs/

- Find frequently asked questions about generative AI at USYD

- Get more inspiration about the use of generative AI in Finance at USYD.