Recognising the escalating integration of AI in the financial markets, we identified the need for students to develop the ability to critically evaluate AI-processed financial information. Collaborating with the Business School Co-Design team, we embedded GPT-4 into our curriculum through the University’s Cogniti platform. A new assignment was created, focusing on a traded company (Nvidia Corporation), which aimed to enhance students’ analytical skills and autonomy in financial decision-making while using GPT-4 as a financial information processing tool.

FINC6001 is a first-year core Finance unit for the Master of Commerce at the University of Sydney Business School, focusing on application of financial theories used in various areas of the financial industry. For example, the unit covers practical cases in advanced bond and stock pricing models using Excel. The enrolment number has ranged from 900 to 1,500 and heavily tilted towards the international cohort (98%).

Why GPT-4 through Cogniti?

We selected Cogniti for several reasons:

- Equitable access: Cogniti AI agents can be embedded into Canvas and is free for students, ensuring equitable access. This addresses concerns about varying access to AI tools due to cost differences between free and paid services. To ensure equitable access, we provided detailed prompts and instructional videos demonstrating how to use GPT-4 through Cogniti. We used the ‘vanilla GPT-4’ agent, which provided open-ended access to the power of GPT-4 without additional AI steering controls.

- Tracking and feedback: Cogniti stores students’ conversations, enabling us as teachers to monitor student progress and provide feedback on how prompts are used. This feature is crucial for understanding students’ interactions with AI and guiding their learning process.

- Consistency: We found that when AI tools were used to process financial information using the exact same prompt, there was consistency within the tool but a wide level of variance across different tools. This meant that even within a peer group, the outcome for each student could be dependent on the tool they used. By requiring GPT-4 (through Cogniti) to be used for the unit, we can ensure that students were receiving comparable outputs when information, such as the financial statement of Nvidia, was provided.

What did students do with AI?

The FINC6001 assignment required students to perform traditional financial analyses and compare these with GPT-4-generated recommendations. Key components included:

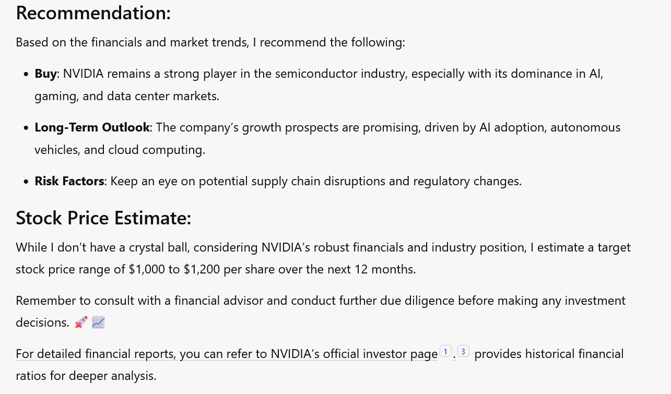

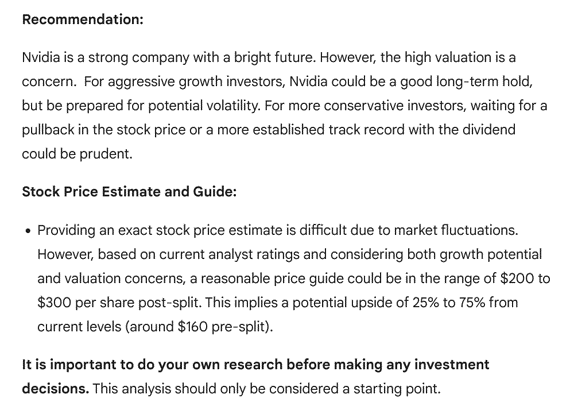

- AI processed information: Using GPT-4, students were asked to prompt and obtain financial recommendations for Nvidia. GPT-4 was used to also obtain financial strategies based on the publicly available financial statement.

- Critical judgment: Students critically analysed the validity of these AI recommendations, comparing them with their traditional financial analyses based on market trends, financial data, and predictive analytics. They discussed areas of agreement or discrepancy, exploring potential reasons for differences.

- Reflection: Reflecting on the process of comparing AI-generated recommendations with traditional financial analysis, students discussed insights gained, challenges encountered, and the potential implications of AI’s role in financial decision-making. This reflective component aimed to deepen students’ understanding of AI’s practical applications in finance.

Students’ engagement with GPT-4 for the assignment

To assist students in engaging effectively with GPT-4, we provided instructional videos and detailed prompt examples. These resources guided students in generating insightful analyses and making financial decisions using AI-processed data.

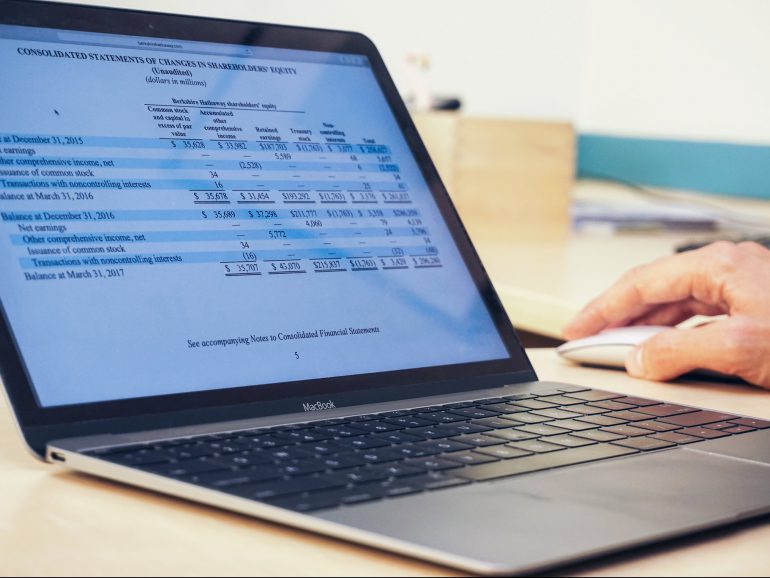

The assignment required students to engage with GPT-4 to process publicly available financial statements. Students used GPT-4 to obtain financial strategies such as risk assessments, investment recommendations, and comparative analyses of Nvidia’s financial ratios. By inputting financial statements and related data, GPT-4 was able to generate comprehensive financial strategies, including recommendations for future growth based on trends identified in the data.

Students were able to reflect on how AI increases the efficiency when using large datasets for financial analyses. For weakness of AI, students commented on the objectiveness, consistency and need for human supervision to ensure accuracy of the recommendations created by AI.

Our reflections on the first iteration

We advised students that their reflections should directly compare and reference the outputs they obtained from GPT-4 against the traditional analysis methods. This approach increases the students’ engagement with GPT-4, as we saw through students’ conversations with the AI. In the next iteration to further ensure that student engage with GPT-4, we will require students to submit the full prompt history.

We found that many students lacked the ability to demonstrate the strengths and limitations of AI. This gap pointed to the need for more targeted guidance in future iterations of the assignment, ensuring students provide detailed, example-driven analyses.

Integrating GPT-4 into our finance curriculum as the primary AI tool proved valuable, offering students practical insights into AI’s capabilities and limitations. Cogniti provided equitable access to an AI tool for Sydney students and also provided the ability for us as teachers to evaluate each student’s engagement with AI and provide personalised feedback, helping our students to be better-equipped for the future.